The National Association for Latino Community Asset Builders (NALCAB) and two individual small business owners have joined the lawsuit filed against the CFPB in May 2019 by the California Reinvestment Coalition in a California federal district court seeking a declaration that the CFPB’s failure to issue regulations implementing Section 1071 of the Dodd-Frank Act violates the Administrative Procedure Act and requiring the CFPB to promptly issue such regulations.

Section 1071 amended the ECOA to require financial institutions to collect and maintain certain data in connection with credit applications made by women- or minority-owned businesses and small businesses. Such data includes the race, sex, and ethnicity of the principal owners of the business. In April 2011, the CFPB issued guidance indicating that it would not enforce Section 1071 until it issued implementing regulations. In May 2017, the CFPB issued a RFI and a white paper on small business lending in conjunction with a field hearing on small business lending. The RFI was intended to inform the CFPB’s Section 1071 rulemaking.

In the amended complaint adding the new plaintiffs, the NALCAB is described as a nonprofit organization whose “mission is to strengthen the economy by advancing economic mobility in Latino communities.” The NALCAB alleges that its members are directly harmed by the CFPB’s failure to implement Section 1071 because they are “hindered in their efforts to provide and secure loans for members of the affected communities.” It claims that without the data mandated by Section 1071, its members “have to expend additional organizational resources–and in some respects are entirely unable–to identify particular needs and opportunities.”

The new individual plaintiffs are both alleged to be women who own small businesses. One of the women is alleged to be a black woman. In the amended complaint, the women allege that they have encountered discrimination in obtaining access to financing for their businesses because of their gender or race and gender. They claim that publication of the data required to be collected by Section 1071 would deter lenders from engaging in such discrimination and that the CFPB’s failure to implement Section 1071 has therefore harmed them by impairing their ability to obtain working capital for their businesses.

While previously classified in the Bureau’s semi-annual rulemaking agendas as a current rulemaking, the Bureau’s Fall 2018 agenda reclassified the Section 1071 rulemaking as a long-term action item. In the Fall 2018 agenda’s preamble, the CFPB attributed the rulemaking’s new status to the Bureau’s need to focus additional resources on various HMDA initiatives. However, in the CFPB’s Spring 2019 rulemaking agenda that was released after the filing of the original complaint by the California Reinvestment Coalition, the Section 1071 rulemaking was restored to current rulemaking status, with January 2020 indicated as the date for pre-rule activity.

In the agenda’s preamble, the CFPB stated that it “intends to recommence work later this year to develop rules to implement section 1071 of the Dodd-Frank Act.” It also stated that it “delayed rulemaking to implement this provision pending implementation of the Dodd-Frank Act amendments to HMDA and started work on the project after the HMDA rules were issued in 2015. The Bureau decided to pause work on section 1071 in 2018 in light of resource constraints and the priority accorded to various HMDA initiatives. The Bureau expects that it will be able to resume pre-rulemaking activities on the section 1071 project within this next year.”

The amended complaint references these statements in the Spring 2019 rulemaking agenda and alleges that they “contain[] no commitment whatsoever as to a timeline for implementation of Section 1071, despite the many years of delay that have already occurred, nor any explanation of why further ‘pre-rulemaking activities’ are needed after the 2017 efforts.” The CFPB has not yet filed an answer or other response to the complaint.

Click here for more details.

Related Posts

August 07, 2024 at 10:48 am

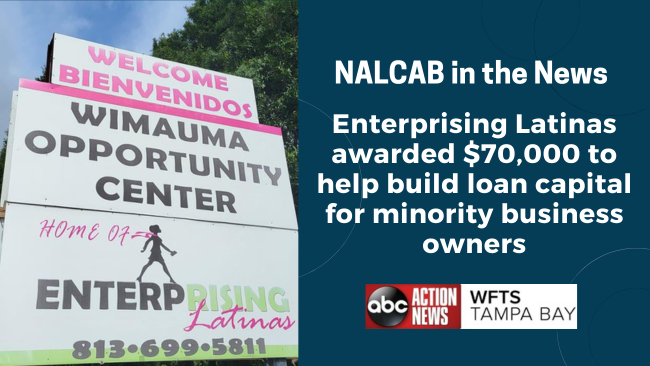

(ABC ACTION NEWS WFTS TAMPA BAY) Enterprising Lati ...Posted by Hallie Chavez

...

July 19, 2024 at 09:41 am

(REUTERS) Capital One pledges $265 billion in lend ...Posted by Hallie Chavez

...

June 17, 2024 at 02:10 pm

(SHELTERFORCE) Are Race-Based Lawsuits Affecting C ...Posted by Hallie Chavez

...

January 18, 2024 at 07:54 pm

(THE PLAYFUL PODCAST) Building Community Wealth On ...Posted by Nidia Alvarado

...