Our Voice.

Our Strength.

LA FUERZA DE NUESTRA VOZ

NALCAB 2024 ANNUAL REPORT

Marla Bilonick

NALCAB President & CEO

“During this era of growth, we are careful not to lose sight of our commitment to providing thoughtful, responsive and individualized attention and support to NALCAB’s 200+ members. We are adding capacity to deepen our engagement and support of those members.”

Letter from the President & CEO

Our Voice. Our Strength | La Fuerza de Nuestra Voz

2024 was an important year for NALCAB and our members. We provided 84 subgrants totaling $2.2 million to 77 organizations—nearly doubling both the number of grants and the total funding awarded to members in 2023. Additionally, we provided over $5 million in loans to our members, further supporting their growth and impact.

NALCAB exists to serve our members, and we know that direct funding from NALCAB to help expand your programming and implement your projects is one of the most meaningful ways that we can contribute to your success. To expand beyond our direct funding, in 2024, we advanced initiatives aimed at connecting our member organizations to funders outside of NALCAB. We held our third annual funder matchmaking event at our National Conference and introduced our members to contacts from corporate and private foundations. Lastly, in this vein, we implemented successful programming to help our members access large-scale federal funding sources, like the CDFI Fund.

This year, we made significant investments in long-term projects, including the launch of our latest strategic plan, which will guide our work in the years ahead. From 2025 to 2027, we will be laser focused on (1) further increasing the flow of capital to our members; (2) strengthening the operational, technical, and leadership capabilities of NALCAB members and their leaders; (3) and increasing visibility for capital investment opportunities in our communities and awareness of the critical role Latinos play in driving the nation’s economy. Along with this new strategic plan, we are unveiling a new logo and branding in 2025.

NALCAB purchased a new building in San Antonio to accommodate our growing staff and signal our long-term presence as a national organization focused on asset building for Latinos—a key strategy for growing the US economy. The building we have purchased holds a deep and significant history of providing financial services to the Latino community in San Antonio, Texas. That history aligns with NALCAB’s organizational DNA. Stay tuned to see our permanent signage along the highway in San Antonio coming in 2025!

2024 was a banner year where we laid a literal and figurative foundation for future years of success and impact in service to NALCAB’s network. No matter what is to come in 2025, we will maintain an unshakeable and unwavering focus on supporting our network of over 200 organizations.

Marla Bilonick

NALCAB President & CEO

Mission

Build transformational wealth in Latino communities to create a more prosperous future for the entire nation.

Vision

A nation where Latino communities thrive, with access to opportunity and prosperity, and the power to shape their own destiny.

Long-Term Impact

Increase economic power to drive lasting prosperity in Latino communities across the United States.

By the Numbers

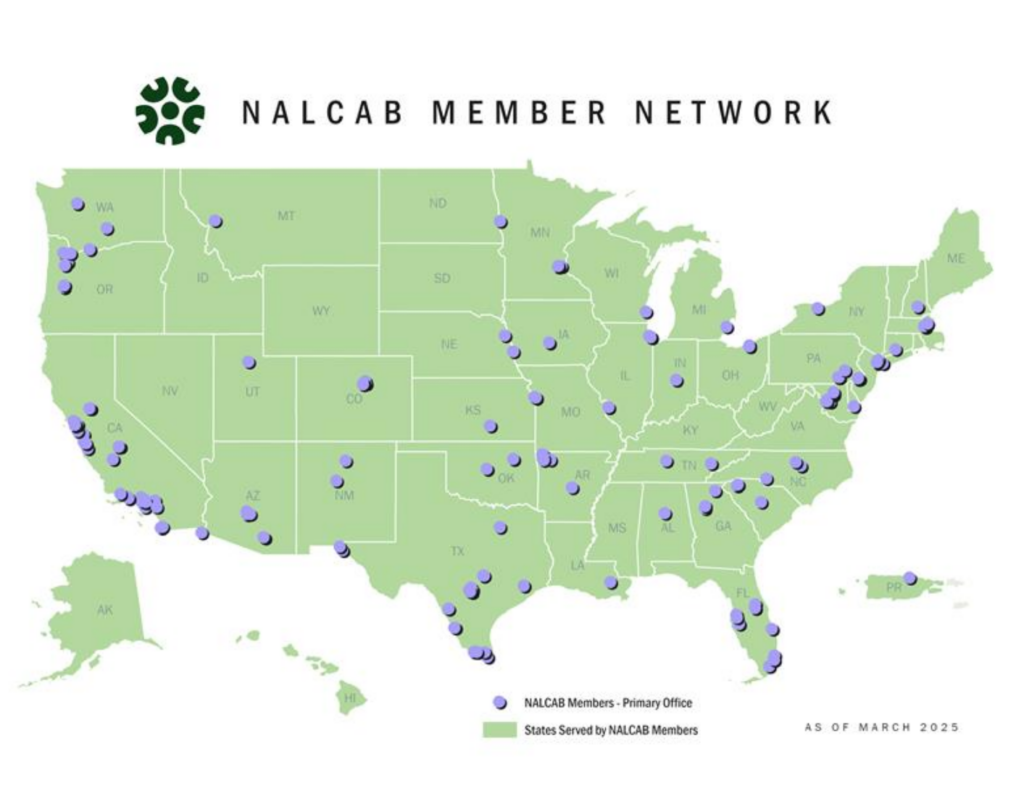

NALCAB grant coverage: 57 Cities/27 States

Total grants to community economic development nonprofits: 84

Total amount of grant funding awarded by NALCAB: $2,228,500

Total number of community economic development professionals trained: 1,052

Total dollar amount of loans made to community economic development nonprofits: $5,020,000

- NALCAB supports its network member organizations through 4 areas of focus:

Capital

Offering opportunities to member organizations to access lending, loan guarantees, grants and impact investing to sustain or expand their work.

Lending

As a US Treasury-certified Community Development Financial Institution (CDFI), NALCAB lends to nonprofit organizations that promote economic mobility across the United States. We help communities build affordable housing, invest in small businesses, and strengthen financial capability. We engage in intermediary lending to small business lenders to support the growth of Latino business owners while also providing secured and unsecured loans to affordable housing developers, including acquisition, pre-development, construction, and bridge financing.

• $5,020,000 in loans to NALCAB members

• 58 small business loan guarantees to member lenders totaling $1,211,023.00

*Organizations that received loans or loan guarantees from NALCAB in 2024

Rural Revolving Loan Fund

The Iowa Center for Economic Success, Des Moines, IA

NALCAB member The Iowa Center for Economic Success comments on NALCAB’s support: “NALCAB’s partnership has been transformative for The Iowa Center and the communities we serve. Their support through lending capital and grant funding has enabled us to provide 14 loans totaling $628,246.84, creating 44 new jobs and making a significant impact in our community. The data demonstrates our commitment to serving small business entrepreneurs – 50 percent of the businesses are Latino-owned, 71 percent are owned by people of color, 64 percent are women-owned, and 86 percent serve low-income communities. Looking ahead, NALCAB’s commitment of $450,000 for rural Iowa initiatives in 2025, along with their support for our CDFI recertification, is crucial. Access to capital in rural Iowa is not just about funding – it is about creating economic opportunities that help our communities thrive and grow. Many rural businesses struggle to access traditional financing, and this support will help fill that critical gap, ensuring that rural entrepreneurs can start and expand their businesses right here in Iowa”

– Jose Venales, Director of Credit and Lending (The Iowa Center for Economic Success)

IMPACT STORY

Centro Para la Reconstrucción del Hábitat

San Juan, PR

In Puerto Rico, where property vacancy rates are among the highest in the US, the Centro para la Reconstrucción del Hábitat (CRH) is addressing a dual crisis: widespread property abandonment and a severe affordable housing shortage. NALCAB supported CRH’s innovative work with a $650,000 bridge loan, enabling the organization to initiate a groundbreaking project funded by an $11.2 million reimbursement-based grant from the Puerto Rico Department of Housing (PRDOH).

CRH is creating an inventory of 50,000 vacant properties across Puerto Rico’s 78 municipalities, focusing on those suitable for redevelopment through HUD’s Community Development Block Grant Disaster Recovery (CDBG-DR) and Mitigation (CDBG-MIT) programs. The project involves geolocated surveys, comprehensive legal and tax assessments, and detailed case files for each property, providing municipalities with ready-to-use data for code enforcement or abatement proceedings.

NALCAB’s bridge loan allowed CRH to cover initial project expenses, including hiring personnel, acquiring equipment, and developing a training and Standard Operating Procedures (SOP) manual. This support ensured CRH could maintain its cash flow and liquidity while awaiting grant reimbursements.

CRH’s work will serve as a catalyst for economic revitalization in areas deteriorated by abandoned properties, paving the way for affordable housing and sustainable community development.

Small Business Loan Guarantee

TMC Community Capital, Oakland, CA

TMC Community Capital, a nonprofit microlender, is committed to providing fast, affordable online financing to foster financial stability and encourage entrepreneurship for small businesses in California.

TMC offers Microloan Lite loans ranging from $5,000 to $15,000 and Microloans up to $50,000 with terms of up to five years. In 2022, TMC experienced substantial growth, hiring its first full-time CEO, doubling its staff, opening a second office in Los Angeles, and quadrupling its loan originations. The organization issued 65 loans totaling $2.13 million to small businesses across 18 California counties.

To support TMC’s mission, NALCAB provided two loans totaling $1.2 million. These funds were fully deployed, resulting in nearly 60 loans. TMC’s success underscores the critical need for continued funding to CDFIs.

Congressional directed spending, also known as earmarks, are a way for legislators to allocate funding to specific projects in their jurisdiction. This is a useful way for our members to have their local projects funded directly through the federal budget. After our March 2024 webinar “Apply for Community Project Funding / Congressionally Directed Spending,” one NALCAB member was inspired to connect with their Senator about a local project. As a result, they received $368,000 in congressionally directed spending from Senator John Fetterman (D-PA). Regarding the detailed information that NALCAB made available during the webinar, she states “You share great resources and opportunities for organizations to help them continue and support their mission. I have never done this before or had the information to do so, so thank you for sharing and empowering me to seek this.”

– Aimee Franqui, Director of Advancement ASSETS: Transforming Communities Through Business.

Capacity

Providing individualized technical assistance, webinars and workshops, as well as tailored training and guidance to members.

Small Business Development

NALCAB supports entrepreneurs nationwide by providing our nonprofit members with resources, training and access to capital needed to enhance and grow their small business development services. Specific activities in 2024 included grantmaking and technical assistance to build capacity in CDFI certification and loan fund capitalization, local and national small business policy advocacy, developing performance indicators and data management tools, and enhancing program and organizational sustainability.

• 4,882 small business entrepreneurs served

• 136 cities in over 39 states served

• 167 nonprofits served

• $698,500 awarded in grants

*Organizations that received grants from NALCAB in 2024

IMPACT STORY

Seed Capital for Lending

Moorhead, MN

NALCAB has been engaged with the Immigrant Development Center (IDC) in Moorhead, MN, through a federal grant to increase their lending capacity to borrowers, specifically through enhancing technological capabilities to automate loans and improve data handling. IDC’s goal is to become a certified CDFI to provide capital to entrepreneurs needing additional support. While providing technical assistance, it became apparent that the primary barrier to IDC achieving this goal was the lack of lending capital. NALCAB carefully assessed the organization’s risk and was able to use $15,000 in grant funding from Surdna Foundation to capitalize the two loans. These initial loans will form the basis of IDC’s eventual CDFI certification application through NALCAB’s CDFI Certification program.

Financial Capability

NALCAB supports nonprofits engaged in financial coaching and wealth building that strengthens communities nationwide. Grants and technical assistance help organizations bolster their services to community members to build generational assets by increasing savings, building credit, and decreasing debt. In 2024, NALCAB provided $600,000 in direct grants, serving 20 network member organizations.

• 14,974 total individuals served

• 887 individuals received financial coaching

• $463,164 in decreased debt

• $675,468 In increased savings

*Organizations that received grants from NALCAB in 2024

IMPACT STORY

Latin American Association

Atlanta, GA

A Latin American Association (LAA) client; a homemaker, and mother of two young children, is devoted to her family and meticulously manages her household and family business finances. Despite her and her husband’s efforts in running their independent construction and painting business, they faced significant financial challenges and a $19,000 debt. The client’s primary goals were to reduce this debt and improve her credit score.

Seeking expert guidance, the client enrolled in the financial education program offered by NALCAB member Latin American Association. Initially overwhelmed by budgeting and tracking household expenses, she committed to the program’s step-by-step plan with the support of her financial coach. By diligently recording expenses, identifying cost-cutting areas, and redirecting savings toward debt repayment, her dedication began to yield remarkable results.

In just four months, the family’s financial situation improved significantly. LAA client and her financial advisor uncovered forgotten savings identified unnecessary expenses and strategically used these funds and savings to pay off debts. As a result, the family’s debt decreased drastically, and her credit score improved exponentially. Reflecting on her journey, LAA client shared, “The financial counseling has been a tremendous help and a relief, providing peace of mind. We found balance and were able to significantly reduce our debt. With the knowledge gained, we opened a savings account and started increasing our savings.”

This LAA client’s story is a powerful testament to how financial counseling can transform lives, enabling individuals to take control of their finances and achieve lasting success and stability.

Neighborhood Development

Refers to the process of revitalizing and improving communities in a way that ensures opportunity for all residents, particularly those who have historically been left behind.

• 120 individuals served

• 122 nonprofits served

• 13 grants awarded

• $600,000 awarded in grants

*Organizations that received grants from NALCAB in 2024

IMPACT STORY

Housing Roundtables

In 2024, with the support of TD Bank, NALCAB’s Neighborhood Development and Financial Capability team hosted four roundtable discussions with housing developers and service providers. These conversations aimed to better understand the challenges our member organizations face in today’s housing landscape.

The first roundtable, held in Charlotte, NC, brought together 12 participants from 8 organizations. A key takeaway was the growing complexity of development financing—most projects require a tapestry of 8-9 funding sources. Additionally, developers are being pushed to find increasingly creative ways to finance projects that require more subsidies than in previous years.

We also learned that there is a strong need for patient capital investment, and greater support to help low-to-moderate income homebuyers become purchase ready. Clients are now spending more time in pre-purchase programs compared to five years ago, requiring a longer runway and additional resources to become purchase ready.

As we continue these critical discussions, we look forward to hosting more roundtables in 2025 to further support our members and drive solutions in housing development.

GIS Mapping

NALCAB’s Data and Mapping team provides members with specialized Geographic Information Systems (GIS) services including data acquisition, visualization, research, and training. NALCAB has also partnered with local universities to develop specialized mapping tools such as the Neighborhood Change Atlas, which allows members to better understand how their neighborhoods are changing. In 2024, our GIS team provided specialized GIS technical assistance to 12 members, mapping for six different cohorts and grants, and data support for 40 unique nonprofits.

Rural Capacity Building

Enhances the capacity and ability of local governments, tribes, housing development organizations, and rural-focused Community Development Corporations (CDCs) to carry out community development and affordable housing activities that benefit low-and moderate-income people in those areas.

• $50,000 awarded in grants

• 1,039 businesses assisted

• $4,110,000 in new or expanded federal funding secured

• 314 jobs created or sustained

• 5 technical assistance assignments

• 4 states & 5 cities served

*Organizations that received grants from NALCAB in 2024

Community Compass

Community Compass is a program designed to help HUD grantees gain the knowledge, skills, tools, and capacity to implement HUD programs and policies efficiently. NALCAB produces bilingual webinars, factsheets, problem-solving clinics, and other communication materials, and also works directly with HUD grantees to address compliance or implementation challenges. In 2024, NALCAB produced 62 products on topics such as Rental Assistance Demonstration (RAD), Tenant Advocacy Basics, Public Housing Resident Organizing and Participation, and the Housing Opportunity Through Modernization Act. NALCAB also provided direct technical assistance to twelve different municipalities.

Training & Leadership Development

In 2024, NALCAB’s Training and Leadership Development programming reached over 1000+ individuals covering topics related to organizational development, finance and lending, advocacy and leadership skills. Of note, were the following highlights:

Pete Garcia Community Economic Development Fellowship

In 2024, NALCAB’s signature fellowship program graduated its 13th cohort consisting of 21 community development professionals from across the US and Puerto Rico. The Pete Garcia Fellowship offers training for next-generation leaders to build practical, personal, and professional skills needed to succeed. It helps practitioners become effective leaders through leadership development, technical training, and the facilitation of peer networks. To date, the Pete Garcia Fellowship has graduated 205 alumni from 122 unique nonprofit organizations from 27 states, the District of Columbia and Puerto Rico.

IMPACT STORY

Pete Garcia Fellowship

The Pete Garcia Fellowship, a 9–12-month leadership development program offered by NALCAB, plays a pivotal role in fostering innovative solutions for community development. The program consists of four in-person trainings and five to six virtual sessions, where fellows engage in facilitated discussions, site visits, and collaborative learning experiences. A central component of the fellowship is the Community Development Project, in which fellows create or expand programs that address critical community needs while aligning with their organization’s mission.

Each year, the fellowship awards a $10,000 grant to the organization with the best community development project presentation. In 2024, Leo Elias Sandoval, a fellow from the Latino Economic Development Center (LEDC), a NALCAB member organization based in Washington, DC, won the seed funding to implement his project. Leo’s initiative, The Homebuyer’s Club, is a powerful example of how community-driven efforts can help bridge the gap to homeownership.

The Homebuyer’s Club is a new initiative by LEDC aimed at supporting aspiring homebuyers in Prince George’s County, MD. Using a cohort-based model, the program will equip participants with the financial literacy necessary to become mortgage-ready. Throughout the program, participants will focus on key milestones such as improving credit scores, increasing savings, reducing debt, and preparing for homeownership. Delivered through monthly 2-hour hybrid sessions—both virtual and in-person—the program will foster a sense of community and mutual accountability among participants. The Homebuyer’s Club is set to launch in 2025.

Latino Executive Advancement & Development (LEAD)

NALCAB launched its new Latino Executive Advancement & Development (LEAD) fellowship program with the support from Capital One in March 2023. This fellowship was specifically designed for Latino Presidents, CEOs, and Executive Directors representing nonprofit organizations that focus on economic asset building. The 15-month program provides training in the areas of cultural intelligence, organizational development, and personal & professional growth.

NALCAB In partnership with the George Washington University’s, Cisneros Hispanic Leadership Institute has created a unique experience beyond basic leadership principles. The LEAD fellowship program is a one-of-a-kind experience for Latino leaders offering relevant experiential training on contemporary challenges for leading community economic development nonprofit organizations with a Latino focused lens, including foundational training on leadership theory, application, and best practices from leader centered experiences.

In 2024, the LEAD fellowship program graduated its inaugural cohort of 9 fellows. In the fall of 2024, applications opened, and fellows were selected for the next cohort to begin in spring 2025.

NALCAB Special Projects

NALCAB’s Special Projects team advances strategic goals and implements innovative programs focused on organizational capacity building and growth. The team oversees grantmaking, technical assistance, and organizational support in the areas of economic development, neighborhood development, and sustainability for our member’s communities.

• 1,792 small businesses served

• 27 grants awarded

• $335,000 awarded in grants

*Organizations that received grants from NALCAB in 2024

IMPACT STORY

Local Emerging Local Support (LENS) Initiative

With the support of the Walton Family Foundation, NALCAB implemented the Local Emerging Local Support (LENS) Initiative. Through LENS, NALCAB conducted a landscape analysis on the community of Northwest Arkansas (NWA), with special attention toward understanding the local nonprofit landscape that predominantly supports Latinos and immigrants in the area. Over the course of the engagement, seven organizations, including Partners for Better Housing were provided with an organizational assessment and identified opportunities for program growth. Additionally, NALCAB supported Partners for Better Housing with resource building and development planning.

IMPACT STORY

Cracking the Federal Code

With support from the Truist Foundation, NALCAB launched Cracking the Federal Code to build the capacity of NALCAB Network members to pursue and manage federal funding. The initiative has provided participants with grants and tailored technical assistance to help them navigate complex federal processes and create competitive applications.

From researching award eligibility and forming consortia to drafting applications and coordinating joint efforts, Cracking the Federal Code has empowered NALCAB members to unlock transformative federal investment that uplifts local communities. As federal funding priorities continue to shift, NALCAB equips members with the tools to adapt, compete, and elevate the contributions of Latinos in the US, ultimately advancing broader national economic prosperity.

Collective voice

Advocating at the local, state, and federal levels on key issues affecting our members and their communities. Providing advisory services and recommendations to government agencies and congressional offices.

Public Policy Advocacy

NALCAB works to inform strategies, conduct research, and collaborate with national partners to address key economic issues affecting Latino communities. We provide resources and insights to support members to navigate policy changes and advocate for economic opportunities in their communities. Our team engages legislators on issues including small business support, access to capital, consumer protections and expanded opportunity that uplift the economic contributions of Latinos in our nation.

Advocacy Day 2024

NALCAB hosted its annual Advocacy Day on June 5, 2024. Each spring, as congressional committees work on the upcoming fiscal year’s budget, NALCAB members come together from across the country to advocate for federal policies that support economic development. This year, 11 NALCAB members traveled to Washington, DC to meet with their congressional representatives, focusing on securing robust federal funding for community and economic development programs. Notable meetings included Senator Rubio of Florida and Representative Castro of Texas. Attendees: Hispanic Unity of Florida, The Allapattah Collaborative Community Development Corporation, Centro Community Partners, Neighborhood Partnership Housing Services, Viva Foundations, LEDC-DC, CASA, Carolina Small Business, LEDC-MN, AYUDA, and Affordable Homes of South Texas.

IMPACT STORY

Accessing Federal Funding

Congressional directed spending, also known as earmarks, are a way for legislators to allocate funding to specific projects in their jurisdiction. This is a useful way for our members to have their local projects funded directly through the federal budget. After our March 2024 webinar “Apply for Community Project Funding / Congressionally Directed Spending,” one NALCAB member was inspired to connect with their Senator about a local project. As a result, they received $368,000 in congressionally directed spending from Senator John Fetterman (D-PA). Regarding the detailed information that NALCAB made available during the webinar, she states “You share great resources and opportunities for organizations to help them continue and support their mission. I have never done this before or had the information to do so, so thank you for sharing and empowering me to seek this.”

– Aimee Franqui, Director of Advancement ASSETS: Transforming Communities Through Business.

NALCAB on the Record

In 2024, NALCAB was at the table with the White House, Federal Agencies and Congress on issues including small business, affordable housing, community and economic development, and funding. Highlights from the year include:

NALCAB played a key role in mobilizing support for SB 1103 which Governor Newsom signed into law in 2024. With this victory, California small businesses & nonprofits will now have increased accessibility. More time to plan and stay in the neighborhood – with longer notice periods for rent increases or termination of tenancies. No more hidden fees – with added transparency and standards for charges related to building operating costs. With these first-in-the-nation commercial protections now signed into law, California is equipped to face displacement and create economic prosperity.

Home Investments Partnership (HOME) Program Rule – In 2024, the U.S. Department of Housing and Urban Development (HUD) released the final rule on the HOME Investment Partnerships Program, including critical Community Housing Development Organization (CHDO) set-aside provisions which NALCAB supported in our July 2024 letter to the agency. These changes will enhance nonprofit housing developers’ access to federal funds and improve affordable housing options.

Comunidad

Bringing member nonprofits together, fostering peer-to-peer connections, and providing training events including NALCAB’s national conference, regional Cafecito convenings and leadership development programs.

NALCAB Cafecitos

NALCAB’s Cafecito convenings continued success in 2024. The regional gatherings of member organizations hosted by NALCAB staff offers a forum for conversations about their organizations’ current initiatives, successes, and plans for the upcoming year. These Cafecitos spanned Tucson, Orlando, and Charlotte, providing a welcoming platform for open dialogue and community building among members in the same geographic area that may not have had a previous opportunity to meet and collaborate.

Through these convenings, the NALCAB team is also able to gain valuable insights into the specific needs and challenges that members face. This collaborative approach informs NALCAB’s resource development strategy and advocacy work, helping to identify and pursue various funding opportunities and assistance that best serves our members.

NALCAB’s 2024 National Conference:

Our Voice. Our Strength | La Fuerza de Nuestra Voz

The 2024 NALCAB National Conference, themed “Our Voice. Our Strength | La Fuerza de Nuestra Voz,” took place in Washington, DC, in September 2024. The event attracted over 407 attendees who had the opportunity to engage with an array of influential speakers, including a keynote from Julissa Arce, activist, former Wall Street executive, and best-selling author. NALCAB was also joined by Isabel Casillas Guzman,

Administrator of the U.S. Small Business Administration, Adrianne Todman: Acting Secretary of the U.S. Department of Housing and Urban Development (HUD), and Pravina Raghavan, Director of the U.S. Department of the Treasury CDFI Fund.

NALCAB’s conference featured a robust agenda of sessions focused on critical topics such as affordable housing, small business strategies, rural development, nonprofit resilience, resource development, government contracting, and strategies for building generational wealth. This three-day event was also an immersive experience, offering training sessions and interactive workshops designed to deepen attendees’ understanding of nonprofit management and economic development. Another key event was the “Visitando el Barrio” bus tour, which took participants through Columbia Heights, DC’s iconic Latino neighborhood. The tour provided attendees with a first-hand perspective on community development and revitalization efforts from local NALCAB member organizations serving the area.

NALCE

The National Alliance of Latino CDFI Executives (NALCE) is a NALCAB initiative that unites and amplifies the voices of Latino-led Community Development Financial Institutions (CDFIs), driving capital to the communities they serve. Since launching in 2022, NALCE’S membership has grown to 93 member organizations across the country. In 2024, NALCE staff participated in over 20 industry panels and roundtables conveying their impact, perspective, and experience. Here is a glimpse of our year’s accomplishments:

- 27 NALCE member organizations received a total of $24.4 million in FY 2024 CDFI Program Financial Assistance awards.

- 15 NALCE member organizations received a total of $3.0 million in FY 2024 CDFI Program Technical Assistance awards.

- Provided 44 members with technical assistance resources at 9 roundtables and webinars on topics including Special Purpose Credit Programs, the Community Power Accelerator, CDFI Certification, and the FY 2024 CDFI Fund Program TA and FA applications.

financials

Revenues & Expenses

2024

2023

Total Support & Revenue*

$16,433,996

$10,464,573

Total Expenses*

$12,181,925

$9,175,880

Change in Net Assets

$4,252,071

$1,288,693

Balance Sheet

Total Assets

$35,241,861

$30,989,790

Total Liabilities

$1,174,046

$1,696,310

Net Assets Attributable to NALCAB

$21,867,056

$18,305,695

Net Assets Attributable to Non-Controlling Interests

$13,374,805

$12,684,095

Total Liabilities & Net Assets

$57,600,845

$46,640,911

Leaders & Supporters

Board Members

Shelly Marquez

Mercy Housing Mountain Plains

President

Henry Jimenez

Propel Nonprofits

President & CEO

Vicky Garcia

Latino Community Credit

Union

CEO

Pedro Ramos

Jeffries, LLC

Senior Vice President

Raul Raymundo

CEO

Duanne Andrade

Executive Director

Mileyka Burgos

Chief Executive Officer

Luis Granados

Chief Executive Officer

Fernando Lemos

Executive Director

Lindsey Navarro

Executive Director

Alicia Nuñez

President & CEO

Emi Reyes

CEO

Pedro Zamora

Executive Director

2024 Funders & Supporters

- Ally Bank

- BlackRock Foundation

- Bank of America

- Capital One

- Citi

- Fannie Mae

- FINRA Foundation

- Insperity

- JPMC

- Latino Community Foundation

- MacArthur Foundation

- Mastercard

- NeighborWorks America

- Opportunity Finance Network

- PNC

- Prudential

- Robert Wood Johnson Foundation

- Target Foundation

- TD Bank

- The David and Lucile Packard Foundation

- Truist Foundation

- US Bank

- Walton Family Foundation

- Wells Fargo

- Wood Forest Foundation